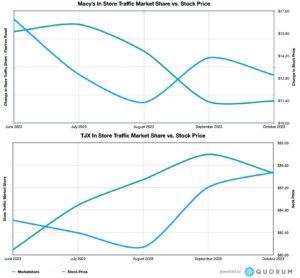

We’ve been keeping an eye on retail trends leading up to this year’s holiday shopping season. Quorum’s detailed and accurate library of GeoFences includes most major retail chains in the US, including all Macy’s and The TJX Companies, Inc. stores, across all brands.

Over the course of this year we’ve watched retail foot traffic migrate from higher end retailers like Macy’s, Nordstrom and Neiman Marcus Group to more modest stores like ROSS DRESS FOR LESS, The TJX Companies, Inc., and Kohl’s. It’s interesting to watch the share of local foot traffic shift over time, and just as interesting to see stock prices follow these trends. Minor changes in foot traffic are amplified or ignored by the stock market, depending on time of year, and how the butterflies are doing in Aruba. Also, sometimes there’s a strong correlation.

Leading up to holiday shopping season, many sources predicted a softening of retail, but in reality that softening was entirely limited to upscale retailers. McKinsey & Company and Boston Consulting Group (BCG) both got it right with their November forecasts that matched the trends we observed in our own retail data – consumers are trading down by skipping high-end retailers and choosing less expensive options.

A couple of interesting related quotes from this fall:

Macy’s CEO Jeff Gennette is quoted as saying “It’s a highly competitive environment, the budgets of our customers are definitely pressed”.

Nordstrom CEO, Erik Nordstrom, has been quoted as saying that there is “continued uncertainty and softening consumer spend.”

The TJX Companies, Inc. CEO, Tommy J. Maxx is not a real person, but if he was he’d say that spending is “firming right up for the holidays”.

The best way to increase retail market share is through targeted advertising to local in-market shoppers using Quorum’s audiences.

Stock movement and retail market share: